Your partner

in progress

Our Guides set you up for success and support you the whole way.

Money Pros that make progress and peace of mind effortless.

All Fruitful Guides are:

CERTIFIED FINANCIAL PLANNER™ Professionals, the highest level of credibility in personal finance.

Focused on building and supporting your personal money system.

Experienced and helpful across all aspects of your finances.

Non-judgmental, kind, and human.

Your Guide gets you on track in no time.

Choose your 1-on-1 Guide and sign up

Complete ~5 minute onboarding flow

Schedule your kickoff session

Meet your Guide, provide more details

Ask any questions you have

Get a full understanding of our process

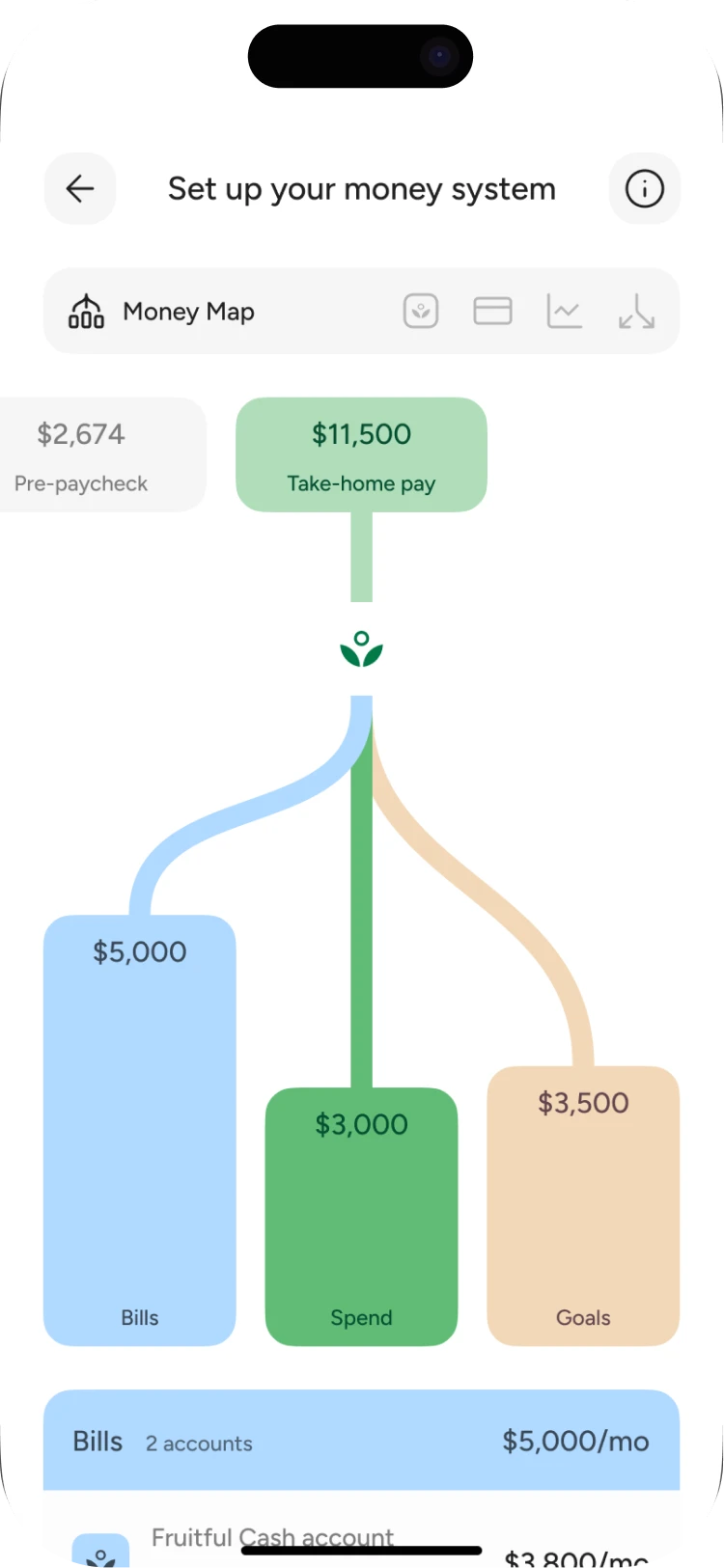

Get your pro-built personalized Money Map

Talk through it with your Guide

Hit “Go” to open accounts and initiate your automatic Income Split rules

Link your income

Your money is now fully automated

Message or meet with your Guide for ongoing support as you need it

Example onboarding journey, exact timing varies

ⓘ

Trustpilot rating based on reviews as of December 1st, 2025. Reviews may not reflect all members experience and are not indicative of future performance. All reviews on Trustpilot can be found at Trustpilot.com/review/fruitful.com.

Join 3,000+ Members who have transformed their finances.

These are current Members we paid in cash for participating in this series. This could create a conflict of interest. Each video is edited to be clear, concise and reflect the experiences of an individual Member, not others, at the time of filming. These testimonials don’t guarantee future performance or success4.

Your goals

are ours too

We’ll guide and support you though all money moments and milestones.

Plan for

a family

Manage money better

Reduce debt

Save and invest smarter

Buy the perfect home

Go on a dream vacation

Eliminate money stress

Change job or career

Frequently Asked Questions

What is Fruitful?

Fruitful is a financial wellness membership that provides access to:

1. Expert advice and support from a dedicated Fruitful Guide, who is a CERTIFIED FINANCIAL PLANNER™ Professional that helps with all aspects of your finances and builds you a tailor-made money system.

2. 4.00% APY1 Fruitful Cash Accounts where you earn on all your money, whether you plan to save or spend it.

3. A secured charge card connected to your Fruitful Cash Account, meaning you can spend responsibly and get up to 2% cash back2 on all your spending.

4. Tailored investment portfolios with expert support at every step and no management fees.

The combo of these 4 core benefits allows our members to organize and optimize their finances in a way that’s simple, smart, stress-free, and sustainable. Members can improve their finances, make real progress toward goals, and eliminate stress. That sounds nice!

Why is it good?

Thinking about money can be stressful and confusing. It’s all too common to have looming anxiety about your finances, feel overwhelmed, or be unsure about how to make progress toward your goals. Our all-encompassing membership makes managing your money easy, effective, and empowering. That means creating an automated money system with easy-to-implement steps. That means creating a blueprint with easy-to-implement steps. That means simpler, smarter ways to save and invest that support your personal goals. And that means doing it all at a transparent, more affordable cost.

Do I need to be a Fruitful Member to access all member benefits?

Yes, an active Fruitful Membership is required to work with a Fruitful Guide, receive a custom money system, and access features like Fruitful Cash Accounts, Card Accounts, and investment management. The good news? You can try it free for your first 14 days. No pressure, no fuss—just access to everything you need to start making real progress. Also, there are no additional fees or costs beyond your subscription.

How do I connect with my Guide?

We’ll set-up and work through 1-to-1 video sessions focused on organizing your finances, setting goals, building wealth, and making real progress. Once we’ve built a strong foundation, we’ll help you keep growing while adapting to whatever life throws your way by providing ongoing advice and support through regular check-ins and anytime messaging. Feel supported at every stage of your journey, wherever it leads.

What credentials do Fruitful Guides have?

All Fruitful Guides are CERTIFIED FINANCIAL PLANNER™ Professionals, the highest level of credibility in personal finance. This means all Guides have met intensive education, training and ethical standards, are equipped to help Members with all aspects of their finances in a capable and trustworthy way, and are required to act as fiduciaries for Members. Guides are additionally registered as investment adviser representatives with Fruitful, a registered investment adviser.

What can Fruitful Guides help me with?

Any part of your life that involves money. Our Guides provide support and advice while considering all aspects of members' financial worlds - from managing monthly finances and getting organized to saving and investing, from buying a home to negotiating compensation and choosing benefits, from strategizing around taxes to starting a family and combining finances, and from retirement to insurance and legacy planning.

Can I change my Fruitful Guide?

Yes, you can change your Fruitful Guide at any time, for any reason. We’re committed to your success, and we'll make sure we find the right Guide for you.

How much does Fruitful cost?

Our pricing is simple and transparent — $48 per month with discounts at longer durations. That’s less than half of the cost of traditional advisory firms.3 And now, new members can get their first 14 days free! We never try to sell financial products to members and our pricing doesn’t change based on your financial profile or complexity. There are no setup or onboarding fees to become a member.

3Cost of traditional advisory firms sourced from The Kitces Report, Volume 2, 2024, Page 121. Pricing Levels.

How does that compare to the cost at other financial companies?

On average, financial planning services cost $250 an hour or about $3,000 per year. Investment managers typically charge 1% on assets managed at a minimum of $250,000.3

3Cost of traditional advisory firms sourced from The Kitces Report, Volume 2, 2024, Figure 121. Pricing Levels.

Why can I trust Fruitful with my money?

Fruitful Advisory LLC is a registered investment adviser that employs full-time Financial Guides, all of whom are investment adviser representatives and CERTIFIED FINANCIAL PLANNER™ professionals. Our Financial Guides have previously worked at top advisory firms like Morgan Stanley, Fidelity, and Merrill Lynch.

Investments in members' accounts are held at and cleared by APEX Clearing Corporation, member FINRA/SIPC, who custodies over $120 billion in total assets as of June 2023. Savings Accounts and deposits are held at Emigrant Bank, Member FDIC and founded in 1850. Learn more about Fruitful in our Legal Documents.

How do I start?

Choose your Guide, sign-up to become a Fruitful Member (try it free for 14 days), complete a short onboarding flow, and schedule your 1st session. Tell us about you. Hear about us. Your financial wellness journey just started.

What if I’m not sure Fruitful is the right fit for me?

We're confident you'll feel better and do better in no time. But if you decide it's not a great fit for you, you can cancel your membership in the first 14 days and pay nothing – guaranteed.

As a member, how can I reach support?

Our hospitality team provides phone and email support Monday through Friday 8 AM – 6 PM ET and 8 AM – 9 PM ET respectively. The team responds to emails within 24 hours, but usually much quicker. Members can also schedule phone or video sessions as well as message anytime with their dedicated Fruitful Guide.

Can I speak to someone before I get started?

Absolutely! Our friendly Fruitful team is available during our regular business hours, 9:30am - 5:00pm ET. Ring us at: (833)700-4052

.png)