Can You Have Multiple Roth IRAs?

A Roth IRA is like the Swiss Army knife of investment accounts—it’s versatile, powerful, and super flexible.

A Roth IRA is like the Swiss Army knife of investment accounts—it’s versatile, powerful, and super flexible.

written by

A Roth IRA is like the Swiss Army knife of investment accounts—it’s versatile, powerful, and super flexible. For retirement, it offers tax-free growth and tax-free withdrawals after age 59½. But that’s not all! You can withdraw your contributions anytime, penalty-free, for any reason, and even tap into your earnings for qualified education expenses. Plus, with access to a variety of investment options, it’s a dream for building a low-cost, diversified portfolio.

With all these perks, it’s no surprise that Roth IRAs are a favorite. But here’s the question everyone wants to know: how many Roth IRAs can you have? And is there a limit to how much you can contribute? Let’s break it down.

How Many Roth IRAs Can You Have?

Technically, you can open as many Roth IRAs as you want—there’s no legal limit on the number of accounts. However, having multiple accounts might mean extra paperwork and management, so it’s usually smarter to consolidate unless you have a specific reason.

Is There a Limit to How Much You Can Contribute?

While you can have multiple Roth IRAs, the annual contribution limit applies across all your accounts. For 2025, the limit is:

- $7,000 if you’re under 50

- $8,000 if you’re 50 or older (thanks to catch-up contributions)

This means you can split your contributions between accounts, but the total can’t exceed these limits.

Why Would You Want Multiple Roth IRAs?

If the contribution limit is the same no matter how many accounts you have, you might be wondering, “Why would anyone bother with more than one Roth IRA?”

Great question! While most people will be just fine with a single Roth IRA, there are a few scenarios where multiple accounts might make sense:

- Inherited IRAs: If you inherit a Roth IRA from someone other than your spouse, it must be kept separate from your own Roth IRA.

- Diversifying Investments: Some investors like to keep their investments separate, maybe one account for stocks, another for bonds, and so on. It’s all about personal preference.

- Different Institutions: Sometimes, one financial institution might have better investment options, while another has better customer service or tools. Multiple accounts let you enjoy the best of both worlds.

Keeping Track of Multiple Roth IRAs

With great power comes great responsibility, right? The more Roth IRAs you have, the more you need to manage.

One big thing to watch out for is overcontributing. Since all your Roth IRAs share a single contribution limit, it’s crucial to keep track of your contributions to avoid going over.

Managing multiple accounts also makes it harder to keep your investments aligned with your overall plan. The more accounts you have, the more complex it can get to ensure your strategy stays consistent and on track.

Final Thoughts

You can open as many Roth IRAs as you like, but the contribution limits stay the same across all accounts. Keeping it simple with one account can make life easier, but if you have specific reasons to use multiple accounts, that’s totally fine too.

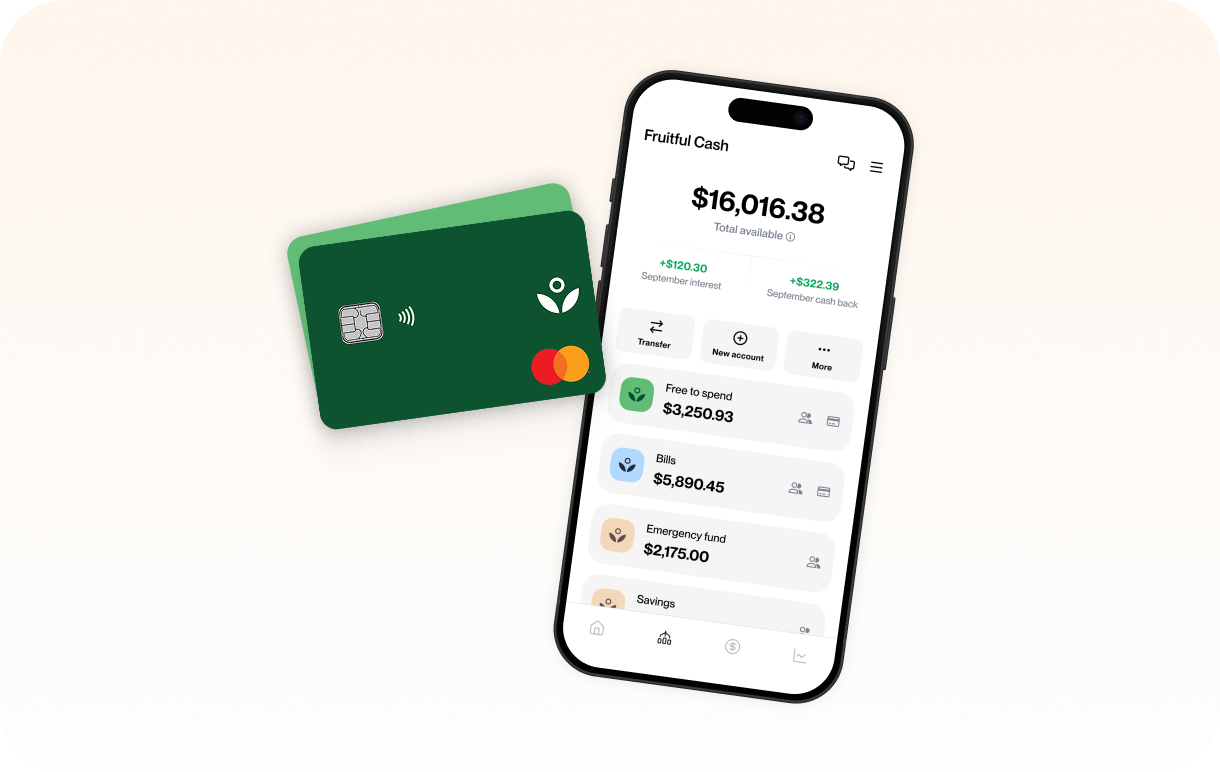

Need help deciding what strategy works best for you? Fruitful’s financial guides can help you build a Roth IRA plan that matches your goals and makes managing your investments a breeze.

Additional articles

© Fruitful 2025 — All rights reserved. “Fruitful” refers to Fruitful, Inc. and its wholly-owned, affiliated, and separately managed subsidiaries, Fruitful Financial, LLC and Fruitful Advisory, LLC, an SEC-registered investment adviser. To learn more about Fruitful Advisory, LLC please view its Form ADV Part 2 and Form CRS available at www.adviserinfo.sec.gov. Registration with the SEC does not imply any level of skill or training.

This information is provided by Fruitful for educational and illustrative purposes only and is not considered an offer, solicitation of an offer, advice, or recommendation to buy, sell, or hold any security. All investing involves risk, including the risk of losing the money you invest, and past performance does not guarantee future performance. Rebalancing cannot assure a profit or protect against loss in a declining market. Fruitful relies on information from various sources believed to be reliable, including information from its Members, Clients, and other third parties, but cannot guarantee the accuracy or completeness of that information.

Fruitful is a financial technology company, not a bank. Deposit accounts provided by Emigrant Bank, Member FDIC. Funds in the bank accounts are insured for up to $250,000 per depositor, depending on the ownership category. Interest rates are variable and subject to change at any time. These rates are current as of July 18, 2024.

¹ The people in these videos are real Fruitful Members who were paid in cash for their time and participation in this series. We think that is fair. Each testimonial reflects the individual Member's experience as an advisory Client and is not intended to represent any other Member's or Client's experience. We believe in the integrity of this approach and that, outside the conflict of interest present due to compensation, no other conflicts apply to these testimonials. These Client testimonials were given in October 2023, represent the opinions of each Member at that time, and may have been edited for brevity and clarity.

² Cost of traditional advisory firms sourced from The Kitces Report, Volume 2, 2022, Figure 61. Distribution Of Typical Annual Retainer Fee.