How Much Should You Contribute to Your 401(k)?

Before deciding on a contribution amount, take a moment to reflect on your financial goals.

Before deciding on a contribution amount, take a moment to reflect on your financial goals.

written by

Deciding how much to contribute to your 401(k) can feel overwhelming. On one side, you’ve got your future self—dreaming of a well-funded retirement. On the other, you’ve got today’s expenses tugging at your wallet.

The good news? You can balance both, and we’re here to help you figure out how.

Start with Your Financial Vision

Before deciding on a contribution amount, take a moment to reflect on your financial goals. Where do you see yourself in retirement? Are you aiming for early retirement, planning a life filled with travel and adventure, or envisioning something more low-key? At the same time, think about your immediate financial priorities—buying a home, paying off debt, or building up your emergency fund.

Your 401(k) contributions are an essential piece of your financial puzzle, but they need to work alongside your other goals. Your contributions should be guided by what you’re working toward—both in the long term and in the near term.

The Employer Match: A Non-Negotiable Starting Point

Here’s the easiest place to start: contribute enough to get your employer’s match. This is essentially free money, and who doesn’t love free money? Many companies match between 3% and 6% of your salary—leaving this on the table means passing up extra cash for your future.

If you’re just getting started with retirement savings, contributing at least this much should be a priority. It’s a fantastic way to kick-start your retirement savings without feeling overwhelmed.

Reflect On Your Lifestyle

After locking in your employer match, it’s time to figure out how much more you can contribute without feeling like your current budget is suffocating. Take a look at your monthly expenses. What’s left after paying for essentials like rent, groceries, utilities, and debt payments? If you’re just starting out, contributing 5% to 10% of your income is a solid goal. You can gradually increase this percentage over time (to say, 15-20%) as your financial situation improves.

Think about your retirement timeline and lifestyle. If early retirement is the goal, you’ll need to ramp up contributions now. If you plan to work longer, you have more time to save. A retirement packed with travel and adventures will require a bigger savings cushion, while a simpler lifestyle might mean you can save a bit less. The key is finding the right balance between your current financial needs and future goals.

Maxing Out Your 401(k)

If you’ve ever heard financial gurus mention “maxing out your 401(k),” they’re talking about hitting the IRS contribution limits. For 2025, those limits are $23,500 if you’re under 50, and $31,000 if you’re 50 or older. Maxing out can offer significant tax advantages since contributions are made with pre-tax dollars, lowering your taxable income.

If this isn’t feasible right now, don’t stress. The goal is to work towards increasing your contributions over time—even a 1% or 2% bump each year can make a big difference over the long haul.

Juggling Other Financial Priorities

Retirement is crucial, but it’s not your only financial priority. You also need to consider things like building an emergency fund, paying down high-interest debt, and saving for life goals such as buying a house or funding your children’s education.

If you have credit card debt or student loans, a solid strategy is to contribute enough to your 401(k) to get the employer match while tackling high-interest debt. Once you’ve made progress in paying off those obligations, you can direct more funds into your retirement savings.

Stay Adaptable

Life changes, and so will your financial situation. That’s why your 401(k) contributions shouldn’t be a set-it-and-forget-it deal. Make it a habit to review your contributions at least once a year. If you get a raise, consider increasing your 401(k) percentage. On the flip side, if you’re going through a financial rough patch, it’s okay to scale back temporarily.

The key is to keep contributing regularly—even if it’s just small amounts.

The Big Picture

There’s no magic formula for 401(k) contributions, and that’s a good thing. It gives you the flexibility to adjust based on your unique financial situation. Start by securing your employer’s match, then gradually increase your contributions as your budget allows. By staying consistent and keeping your eyes on both short- and long-term goals, you’ll set yourself up for a financially sound future.

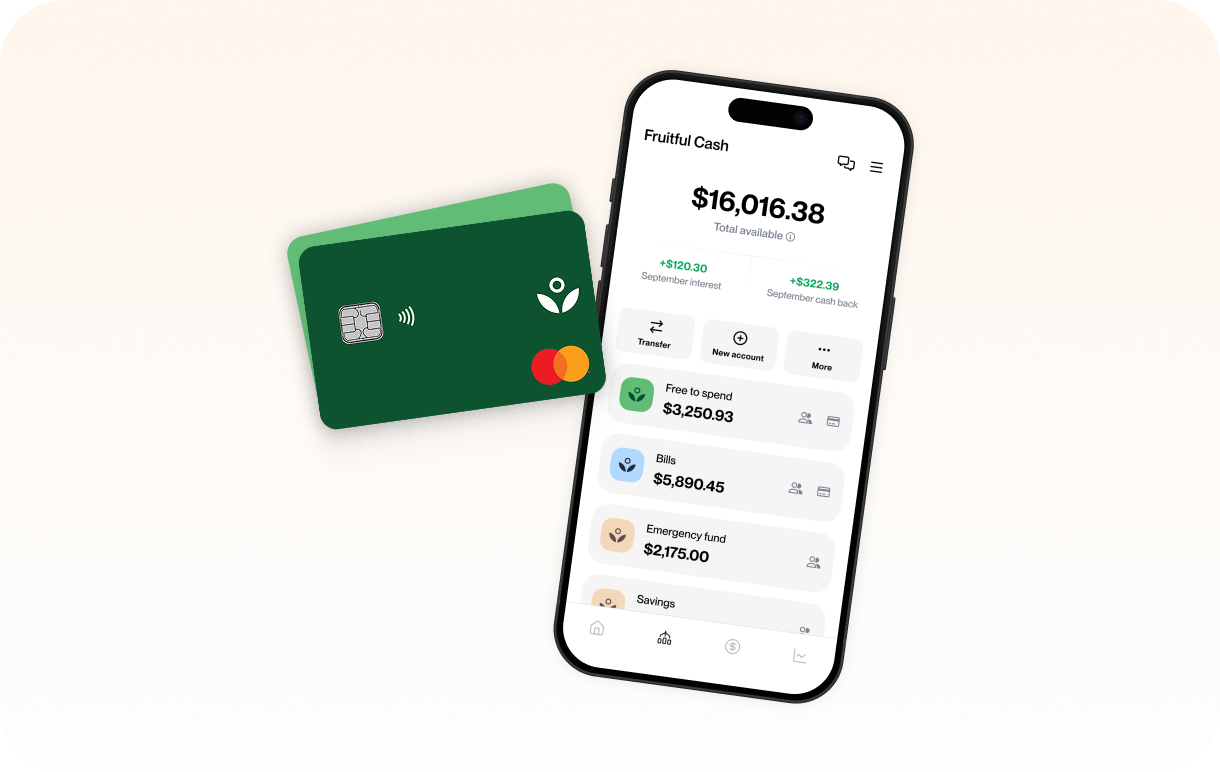

Need help finding the right balance between your current needs and retirement dreams? Not sure how much you need to be contributing to take care of future you? Fruitful’s financial guides can provide personalized advice based on your goals, making sure you’re saving for the future without sacrificing your present.

Additional articles

© Fruitful 2025 — All rights reserved. “Fruitful” refers to Fruitful, Inc. and its wholly-owned, affiliated, and separately managed subsidiaries, Fruitful Financial, LLC and Fruitful Advisory, LLC, an SEC-registered investment adviser. To learn more about Fruitful Advisory, LLC please view its Form ADV Part 2 and Form CRS available at www.adviserinfo.sec.gov. Registration with the SEC does not imply any level of skill or training.

This information is provided by Fruitful for educational and illustrative purposes only and is not considered an offer, solicitation of an offer, advice, or recommendation to buy, sell, or hold any security. All investing involves risk, including the risk of losing the money you invest, and past performance does not guarantee future performance. Rebalancing cannot assure a profit or protect against loss in a declining market. Fruitful relies on information from various sources believed to be reliable, including information from its Members, Clients, and other third parties, but cannot guarantee the accuracy or completeness of that information.

Fruitful is a financial technology company, not a bank. Deposit accounts provided by Emigrant Bank, Member FDIC. Funds in the bank accounts are insured for up to $250,000 per depositor, depending on the ownership category. Interest rates are variable and subject to change at any time. These rates are current as of July 18, 2024.

¹ The people in these videos are real Fruitful Members who were paid in cash for their time and participation in this series. We think that is fair. Each testimonial reflects the individual Member's experience as an advisory Client and is not intended to represent any other Member's or Client's experience. We believe in the integrity of this approach and that, outside the conflict of interest present due to compensation, no other conflicts apply to these testimonials. These Client testimonials were given in October 2023, represent the opinions of each Member at that time, and may have been edited for brevity and clarity.

² Cost of traditional advisory firms sourced from The Kitces Report, Volume 2, 2022, Figure 61. Distribution Of Typical Annual Retainer Fee.